Chapter 05

The Universal Service Provision Fund (“USP Fund”) was established under Section 204 of the Communications and Multimedia Act 1998 and is administered under the Communications and Multimedia (Universal Service Provision) Regulations 2002 (“USP Regulations”) which are specifically enacted for reducing the digital divide that exists in underserved areas and also to underserved groups in society. In line with the USP Regulations, it is mandatory for telecommunication services companies that record a net revenue of more than RM2 million for the financial year under review to contribute 6% of the determined net revenue to the USP Fund each year.

USP Fund prepares the financial statements in accordance with the Malaysian Financial Reporting Standards (MFRS) which is adapted from the International Financial Reporting Standards (IFRS). The financial statements of the USP Fund for the financial year ended 31 December 2021 were audited by Messrs. Ernst & Young PLT.

In general, the financial policies and procedures currently being used and in force, are updated from time to time to ensure effectiveness in the delivery of the USP Fund services.

In line with Government’s aspirations in continuing to deliver excellent and effective services to the relevant stakeholders, USP Fund constantly review the work processes in order to improve and add value, in line with a more holistic and up-to-date operational digitisation initiatives. Among the continuous improvement measures are as follows:-

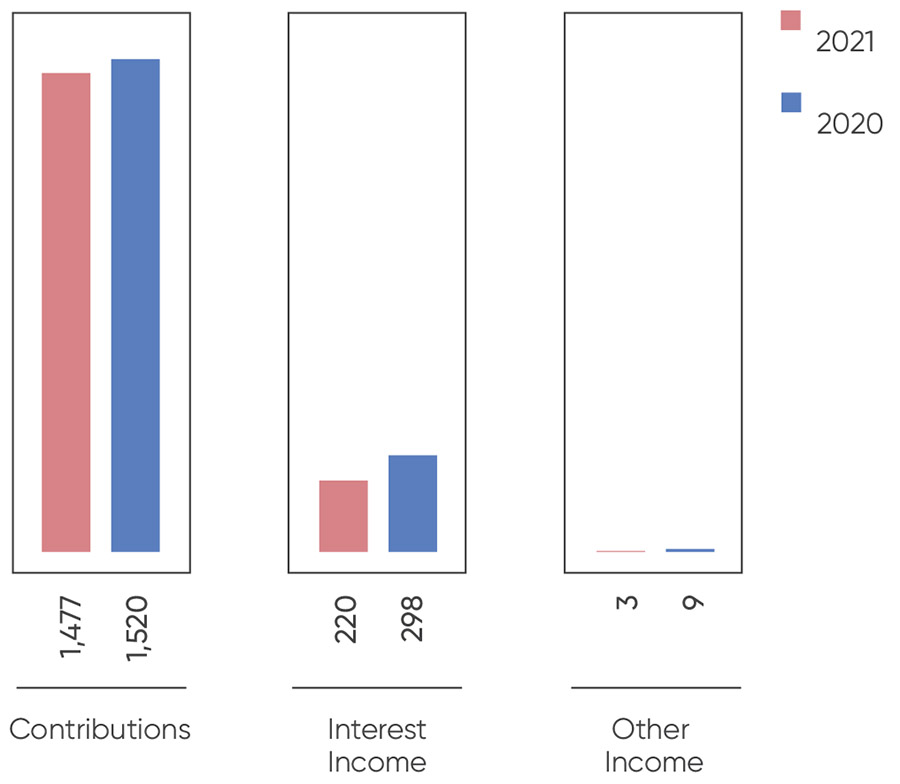

For the year ended 31 December 2021, the USP Fund generated a total revenue of RM1.70 billion. Of the total income, 87% represents the core income while the remaining 13% represents the non-core income. Core income comprises licensee contributions amounting to RM1.47 billion which recorded a decrease of 3% or RM42.7 million compared to the previous year of RM1.52 billion.

However, non-core income which is the interest income, recorded a decrease to RM220 million which is 26% or RM78.3 million and other non-core income which is 67% or RM6.3 million compared to the 2020 financial period. A slight decrease in total core income compared to 2020 was due to a reduction in net revenue from licensees and a decrease in interest income due to lower average interest rate of 2.23% compared to 2.62% recorded in 2020. This is due to the reduction in the Overnight Policy Rate (OPR) since January 2020.

The main expenditure of the USP Fund is attributable to the cost of USP projects implemented by DUSP. A total of RM870.4 million has been recognised as paid and accrued expenditures as compared to RM877.4 million in the year 2020.

The surplus after tax recognised for the financial year ended 2021 decreased by RM122.9 million to RM559.9 million compared to the previous year which amounted to RM682.8 million. In comparison, the surplus after tax representing recognised profits reduced due to lower revenue contribution from licensees and lower interest income for fixed deposits.

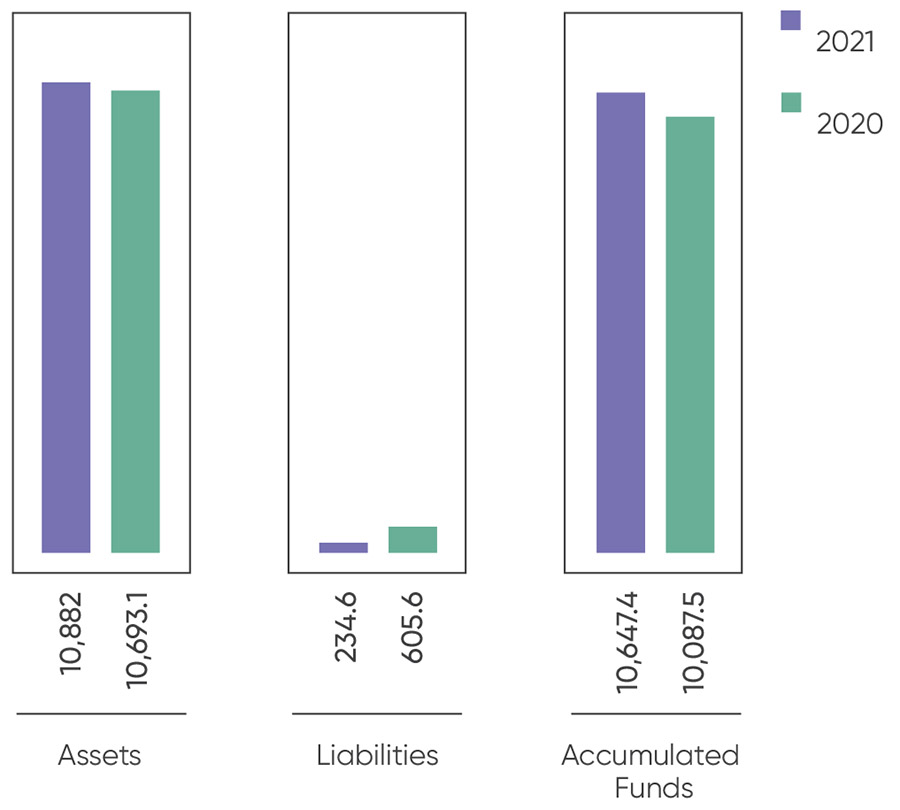

The USP Fund ended the financial year 2021 with assets amounting to RM10.9 billion compared to RM10.7 billion at the end of the previous financial year. There was an increase in other investments comprise of deposits with licensed banks, which was due to a reduction in the payment of USP project costs compared to the previous year. MCMC continues to maintain sound collection procedures to minimise credit risk with a total Contributions and Other Receivables of RM752.7 million compared to RM784.4 million in 2020 respectively.

Liabilities as at 31 December 2021 decreased by RM258.2 million to RM229.9 million compared to RM488.1 million recorded in the previous year. This was due to the implementation of improved payment process initiatives and system upgrades during the year which resulted to improved payment timeline compared to the previous year.

compared with 2020

For the financial year ended 2021, the USP Accumulated Funds recorded an increase of 5% or RM0.5 billion to RM10.6 billion from RM10.1 billion recorded in the previous year. The main contributing factor to the increase in the Accumulated Funds was the surplus after tax of RM559.9 million.

compared with 2020

In line with the Government’s efforts in bridging the digital divide, for the financial year ended 31 December 2021, the USP Fund implemented the USP programmes with a cumulative commitment of RM10.9 billion, covering amongst others, the JENDELA Phase 1 project. Among the projects currently being implemented are as follows:-